CloudAgents - OD-One

The Hub

of your supplier invoices.

From September 2026, the implementation of the electronic reform will impact all companies which will have to accept electronic invoices. On this date, large companies and mid-sized companies will send their invoices to the portal chosen by the company. Then this emission obligation will apply to SMEs/VSEs in September 2027.

From January 2024, you will be able to choose the portal on which your company will receive its invoices. Either the Partner Dematerialization Platforms (PDP) or the Portal Publique de Facturation (PPF). 99% of VSEs will choose the PPF because it is free and includes the archiving of invoices for 10 years. If you do not create an account, you will not be able to access your invoices and your accountant will not be able to account for them!

Frequently Asked Questionsarrow_right_alt

Factur-X

Fournisseur

Plateforme de Dématérialisation Partenaire

PDP

Annuaire

500003710

Portail Publique de Facturation

PPF

Securibox Opérateur

OD-One

Client: 500003710

Cabinet

Societé: 500003710

Client

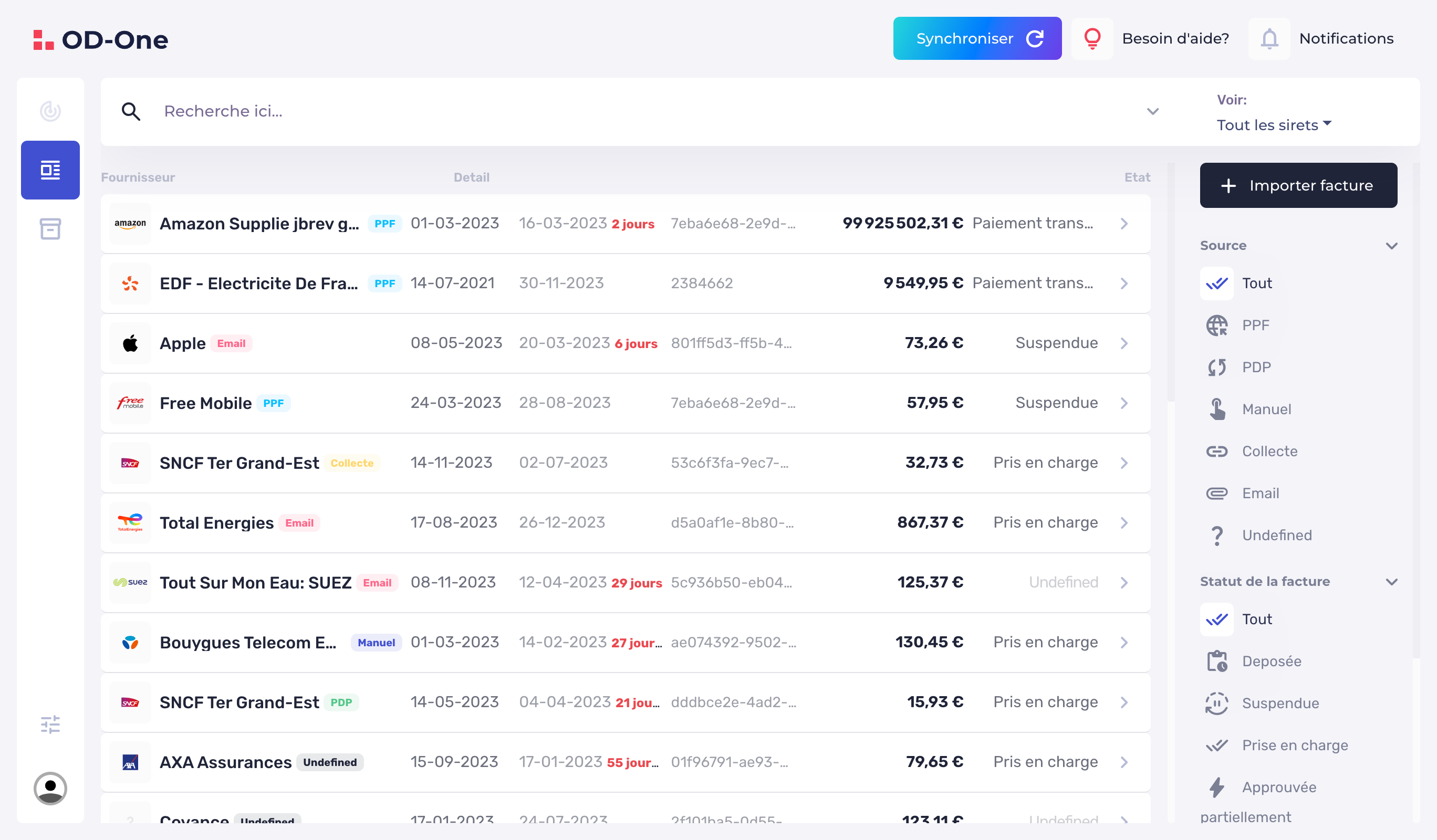

Features OD-One.

- Receipt of supplier invoices from the PPF;

- Management of the life cycle of supplier and customer invoices;

- Receipt of invoices by email, upload or collectors;

- Sending customer invoices in Factur-X format via the PPF;

- Sharing invoices with your accountant;

How does the

solution work?

- A large company sends its PDP an invoice in Factur-X electronic format.

- The PDP identifies the recipient SIREN/SIRET from the XML file, the PDP consults the company directory to identify the portal chosen by the client to receive his invoices. In our case, the customer has decided to receive his invoices on the PPF.

- The PDP sends the invoice to the PPF.

- OD-One periodically retrieves the client's invoices, which can be shared with the client's accountant.

Frequently Asked Questions

If you have any questions, comments or suggestions, please contact us by filling out our form.

On 1 July 2024, the obligation to receive invoices in electronic format will be mandatory for all companies, regardless of their size, as soon as their supplier is obliged to issue invoices in electronic format.

The obligation to issue invoices in electronic format will be applied progressively, in 3 stages. From July 1st 2024 for large companies (more than 5000 employees), from January 1st 2025 for ETI (between 5000 and 250 employees), from January 1st 2026 for small and medium-sized companies (less than 250 employees).

The B2B e-Invoicing obligation as an extension of the B2G obligation (article 289 bis CGI)

The actors can exchange data in 3 formats. The TPE can choose the format it wants to receive. Two structured XML formats: the UBL (OASIS Organization for the Advancement of Structured Information Standards) in the form of the Universal Business Language standard in version 2.2 and the CII UN/CEFACT (United Nations Centre for Trade Facilitation and Electronic Business) in the form of the CCTS (Core Component Technical Specification) in version 3.0

The last format is Factur-x which is a mixed format. It is your good old PDF with an XML file inside that contains all the invoice data. No need to scan invoices and paper and use OCR.

This will be the format that the MSE will choose to receive its invoices. To send electronic invoices, the MSE will need software capable of generating Factur-X.

In addition to the invoice data, buyers, suppliers and their respective platforms must transmit the invoice processing statuses.

Four statuses are mandatory and others are recommended.

On the supplier's side: the 2 statuses are Submitted (updated by his platform) and Collected. On the customer side: the 2 statuses are Rejected (updated by his platform) and Refused.

Your invoice processing software will have to communicate with the portals to update these statuses

The electronic invoice … necessarily includes a minimum of data in structured form, which differentiates it from paper or PDF invoices. The transmission of the invoicing data is mandatory in an EN16931 syntax (semantic model). You can download this standard for free on the AFNOR website.

A scanned invoice or a PDF generated from an office tool will not be considered as an electronic invoice. They will be rejected by the portals. Four new mentions will be mandatory, starting in 2024:

- Customer's SIRET;

- Category of operations : Good / Service / Mixed;

- Delivery address of the goods (if different from the billing address);

- VAT on debits, if applicable;

From 2026, 8 other mentions will have to be provided (information at line level)

Security,

always the priority.

Our website and application traffic run entirely over encrypted SSL and HTTP strict transport security to ensure that browsers interact with Securibox exclusively over HTTPS, meaning that credentials and other sensitive data is never leaked over the network.

“When accessing our application, along with each request, a unique token is sent thus protecting against Cross Site Request Forgery (CSRF). All the sensitive data stored within our servers is encrypted with AES 256-bit and rotating keys, so that the way the encryption is constantly changing."